The 2020s have been brutal for brands that once dominated shopping malls and Main Streets.

We’re talking about retailers that survived the Great Depression but couldn’t handle Instagram.

These weren’t struggling startups run by kids in hoodies.

They were established empires with marketing budgets bigger than some countries’ GDPs.

And they still managed to crash and burn in record time.

1. Bed Bath & Beyond

The iconic home goods retailer closed all stores in 2023 after 52 years in business.

The New Jersey-based company filed for Chapter 11 bankruptcy in April 2023 with $5.2 billion in debt.

At its peak, the store was a wedding registry favorite and a go-to destination for new homeowners.

The company couldn’t compete with Amazon and Target as shopping habits changed.

All 360 Bed Bath & Beyond stores and 120 Buy Buy Baby locations shut down by July 2023.

Why It Fell Off Hard: The company failed to adapt to online shopping trends and lost customers to competitors offering better prices and convenience.

2. Toys “R” Us

The beloved toy store chain filed for bankruptcy in September 2017 and liquidated all US stores by March 2018.

Around 885 stores closed permanently, putting 30,000 jobs at risk.

Competition from Walmart, Amazon, and Target crushed the once-dominant retailer.

The company tried a comeback in 2019 with two new stores in New Jersey and Texas.

Those reopened stores closed again in January 2021 due to Covid.

Why It Fell Off Hard: Heavy debt from a private equity buyout and failure to modernize its business model led to its demise after decades as America’s go-to toy store.

3. JCPenney

The department store giant filed for bankruptcy in May 2020 after years of declining sales.

The retailer closed 242 stores, representing 29% of its 846 locations.

JCPenney had been a shopping mall anchor store for generations of American families.

The company struggled with multiple failed reinvention attempts before bankruptcy.

Strategic missteps and changing consumer preferences pushed the 118-year-old retailer to the brink.

Why It Fell Off Hard: The once-trusted retailer couldn’t keep up with fast fashion competitors and online shopping, losing relevance with both Baby Boomers and younger shoppers.

4. GNC

The vitamins and supplements retailer filed for Chapter 11 bankruptcy in June 2020.

GNC announced plans to close between 800 and 1,200 stores out of approximately 7,300 worldwide.

The company had been planning store closures since 2018, focusing on mall locations.

COVID-19 created the final blow that prevented the company from refinancing its debt.

The pandemic’s sudden impact had a dramatic negative effect on the business.

Why It Fell Off Hard: Mall traffic declined sharply while online vitamin retailers and big-box stores offered cheaper alternatives, making GNC’s store-heavy model unsustainable.

5. Gap

The once-iconic denim brand lost its connection with multiple generations of shoppers.

Gap announced plans in 2020 to close 30% of its Gap and Banana Republic stores by 2024.

The brand that defined casual American style in the 1990s couldn’t keep up with fast fashion.

Competitors like H&M, Zara, and Target stole away Gap’s core denim customers.

Old Navy and Athleta now represent 70% of the company’s sales, overshadowing the flagship brand.

Why It Fell Off Hard: Gap failed to engage Baby Boomers who grew up with the brand while also missing Gen Z and Millennials, leaving it without a clear customer base.

6. Starbucks

The coffee giant’s reputation dropped from 71.5 points in 2021 to 57.7 points in January 2025.

Global comparable store sales declined 2% in 2024, with the trend accelerating into 2025.

First quarter 2025 saw comparable transactions down 8% in the United States.

The company dropped from number 15 to number 45 in global brand value rankings.

Starbucks lost customers’ goodwill and no longer feels like the community gathering place it once was.

Why It Fell Off Hard: The brand lost its way as a cozy third place between home and work, becoming just another expensive coffee chain without the special atmosphere that made it beloved.

7. Victoria’s Secret

The lingerie retailer faced sluggish sales and criticism throughout the early 2020s.

A dramatic 2021 rebrand abandoned the brand’s signature aspirational style and fantasy appeal.

The company replaced its famous Angels with a focus on empowerment messaging.

But here’s the deal: the rebrand alienated loyal customers while failing to attract new ones.

By 2025, Victoria’s Secret had to return to its original identity to stop the bleeding.

Why It Fell Off Hard: The brand mistook loud cultural criticism for actual customer demand, abandoning what made it special to chase trends that its real customers never wanted.

8. Nike

The athletic giant’s brand value dropped from $47.9 billion in 2023 to $33.7 billion in 2025.

That’s a staggering decline of $14.2 billion in just two years.

Gen Z consumers, aged 13 to 28, showed little interest in the once-dominant brand.

Younger shoppers increasingly prefer second-hand options, fast fashion, and replicas.

Nike’s Jordan brand briefly appeared in top rankings in 2024 but couldn’t maintain its position.

Why It Fell Off Hard: The brand that once symbolized athletic excellence lost its cultural cachet as younger consumers rejected premium pricing for more affordable alternatives.

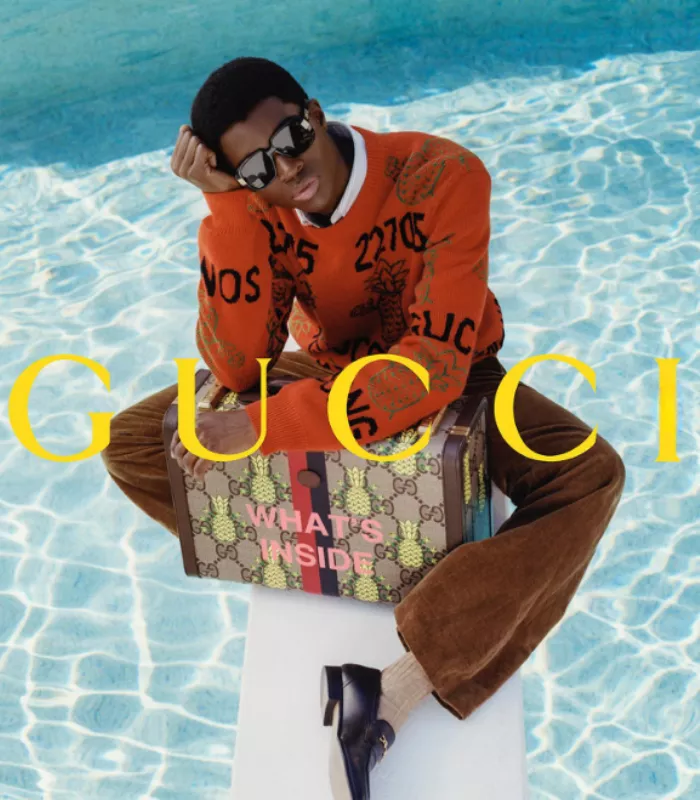

9. Gucci

The luxury fashion house saw its brand value decline for consecutive years in 2024 and 2025.

Declining consumer demand hit the high-end fashion brand particularly hard.

Luxury brands struggled as economic uncertainty made consumers more cautious with spending.

Gucci couldn’t escape the broader trend affecting premium fashion houses.

The brand that once represented aspirational luxury faced increasing competition from newer labels.

Why It Fell Off Hard: Changing luxury consumer preferences and economic pressures caused even established high-end brands to lose their dominant market position.

10. True Religion

The denim retailer filed for bankruptcy in 2020 as remote work ended demand for trendy jeans.

Temporary store closures during COVID-19 devastated the already-struggling brand.

True Religion emerged from bankruptcy in October 2020 but closed numerous locations.

The brand that once charged premium prices for designer denim couldn’t justify its cost.

You’re better off finding affordable jeans at Target than paying True Religion prices anymore.

Why It Fell Off Hard: The shift to work-from-home eliminated the need for expensive designer jeans, and the brand couldn’t pivot fast enough to changing fashion preferences.

11. Sears

The once-mighty department store chain filed for Chapter 11 bankruptcy in October 2018 with 700 stores.

Sears had been a retail giant since the late 1800s, dominating American shopping for over a century.

The company closed 80 more stores in early 2019 as it teetered on the brink of total liquidation.

By 2020, only 182 Sears and Kmart locations remained from thousands that once existed.

The 130-year-old retailer became a cautionary tale of failing to adapt to modern retail.

Why It Fell Off Hard: Years of underinvestment, outdated stores, and failure to compete with Amazon and Walmart turned the former retail king into a struggling shell of its former self.

12. Subway

The sandwich chain closed 631 locations in 2024, dropping below 20,000 US stores for the first time in 20 years.

Subway has closed 7,600 restaurants since 2015, a loss of 28% of its locations.

The chain peaked at 27,100 US restaurants in 2015 but fell to just 19,502 by the end of 2024.

That’s the deal: Subway closed more locations than the entire number of Taco Bell restaurants that exist.

Sales dropped 3.8% in 2024, causing the chain to fall from number 8 to number 9 among top restaurant chains.

Why It Fell Off Hard: Overexpansion led to too many stores competing with each other, while quality concerns and better fast-casual options gave customers reasons to eat elsewhere.

13. Forever 21

The fast fashion retailer filed for bankruptcy twice, first in 2019 and again in March 2025.

Forever 21 closed all 354 US stores by May 2025 after struggling against Shein and Temu.

The company couldn’t compete with ultra-fast fashion brands offering even cheaper prices and faster delivery.

Forever 21 had been delaying rent and royalty payments for years to keep unprofitable stores open.

The brand that defined mall shopping for young people completely exited the US market.

Why It Fell Off Hard: Online competitors from China crushed the mall-based retailer by offering cheaper clothes and direct-to-consumer shipping that made physical stores obsolete.

14. Pier 1 Imports

The home decor retailer filed for bankruptcy in February 2020 and liquidated all stores by October 2020.

Pier 1 originally planned to close 450 stores, nearly half its locations, before going under completely.

The company operated for nearly 60 years before COVID-19 delivered the final blow.

All 541 US stores shut down as the company failed to find a buyer for its business.

The retailer sold off its intellectual property and e-commerce business by mid-July 2020.

Why It Fell Off Hard: The pandemic made it impossible to recover from years of declining sales as consumers shifted to Amazon and Target for home goods at better prices.

15. Rite Aid

The pharmacy chain filed for bankruptcy twice, in October 2023 and again in May 2025.

Rite Aid closed all remaining locations by October 2025 after decades in business.

More than 520 stores shut down between the two bankruptcy filings, representing 25% of locations.

The chain was once known for its convenient locations and in-store ice cream treats.

Financial difficulties and the rapidly changing retail healthcare landscape proved too much to overcome.

Why It Fell Off Hard: Competition from CVS and Walgreens, plus retail giants like Walmart offering cheaper prescriptions, left Rite Aid with no competitive advantage worth keeping.

16. Bath & Body Works

The fragrance and personal care retailer saw its stock plummet 45% in 2024 and early 2025.

Sales fell as the company abandoned its core products to chase growth in new categories like shampoo and laundry detergent.

Third quarter sales declined 1% while the company lowered its full-year outlook multiple times.

CEO Daniel Heaf admitted the previous strategy failed to drive growth and hurt bestselling items.

Customers didn’t want to buy cleaning products from a store famous for candles and body lotions.

Why It Fell Off Hard: Leadership ignored what customers actually wanted, chasing trends in categories where the brand had no credibility while neglecting the beloved products that built the business.

17. American Eagle Outfitters

The casual clothing retailer withdrew its 2025 financial outlook in May citing macro uncertainty.

American Eagle took a $75 million write-down on spring and summer inventory that didn’t sell.

First quarter 2025 revenue dropped 5% with same-store sales down 3%.

The company expects an adjusted operating loss of $68 million for the first quarter.

Both American Eagle and Aerie brands saw declining comparable sales as customers cut discretionary spending.

Why It Fell Off Hard: Merchandising strategies missed the mark completely, forcing heavy promotions and inventory write-downs while tariffs and rising costs squeezed already thin margins.

18. Revlon

The iconic cosmetics brand filed for Chapter 11 bankruptcy in June 2022 with over $3 billion in debt.

Revlon struggled with rising competition, supply chain problems, and falling behind beauty trends.

The company’s shares lost 13% of their value within hours of the bankruptcy announcement.

Lenders took ownership of over 80% of the reorganized company, wiping out longtime owner Ron Perelman.

Revlon exited bankruptcy in 2023 but emerged with $1.5 billion in debt still outstanding.

Why It Fell Off Hard: The once-dominant beauty brand couldn’t keep up with younger, trendier makeup companies and influencer brands that better understood modern beauty consumers.

19. Lord & Taylor

The historic department store filed for Chapter 11 bankruptcy in August 2020 after 194 years in business.

Lord & Taylor launched liquidation sales at 19 of its 38 stores immediately.

The remaining stores soon followed as the company failed to find buyers for profitable locations.

The retailer was America’s oldest department store chain before its collapse.

COVID-19 accelerated problems that had been brewing for years as mall traffic disappeared.

Why It Fell Off Hard: The nearly 200-year-old retailer couldn’t survive the one-two punch of declining mall traffic and pandemic store closures that eliminated any chance of recovery.

20. Brooks Brothers

The classic menswear retailer filed for bankruptcy in July 2020 and closed 51 stores.

Brooks Brothers dressed 40 US presidents over its 200-year history before collapsing.

The shift to remote work devastated demand for business suits and dress shirts.

Private equity firm Authentic Brands and retailer Simon Property bought the brand out of bankruptcy.

The company that defined American business attire became a casualty of casual dress codes.

Why It Fell Off Hard: Work-from-home eliminated the need for expensive suits and ties, leaving a 200-year-old institution with no customers for its formal business clothing.